M&A

Our M&A consulting services are designed to help organizations navigate complex transactions, unlock strategic value, and achieve seamless integration. With a team of experienced advisors and industry experts, we provide end-to-end support across the deal lifecycle — from opportunity identification and due diligence to post-merger integration and performance optimization. We combine financial insight, operational expertise, and strategic foresight to ensure every transaction delivers measurable business impact. Our approach goes beyond numbers — we focus on cultural alignment, synergy realization, and sustainable value creation

A snapshot of the milestones and achievements that drive our success

8+

Years of Experience

50+

Experts

100+

Successful Campaigns

20+

Industry Awards

500%

ROI for our clients

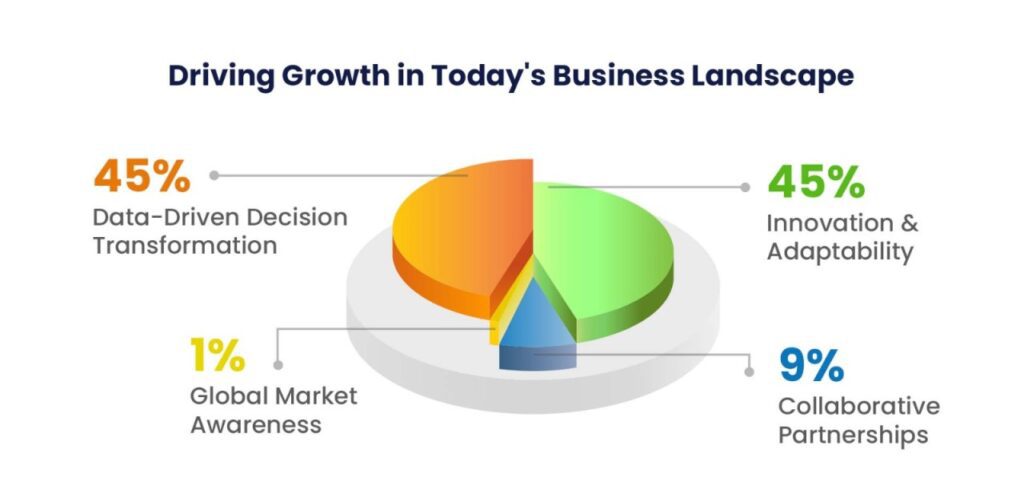

Creating Sustainable Value Through Smart M&A

The question today isn’t whether to pursue mergers and acquisitions — it’s how to execute them in a way that creates lasting, measurable value.

Our approach is simple yet strategic:

Use M&A as a core pillar of your growth strategy, anticipate opportunities before they arise, and build a repeatable acquisition model perfected through experience, discipline, and continuous improvement.

Our M&A advisory experts support clients at every stage to:

Enhance deal success rates by refining M&A strategy, strengthening internal capabilities, and establishing a consistent, scalable acquisition framework.

Elevate due diligence through a rigorous, data-driven assessment that identifies true synergies, mitigates risks, and sets the foundation for seamless integration.

Maximize post-merger value with structured integration programs that capture synergies, ensure cultural alignment, and unlock long-term performance gains.

Optimize divestitures and partnerships by preparing assets for sale, managing carve-outs, and shaping the remaining business for sustained growth — while maximizing returns from spin-offs and joint ventures.

Through this comprehensive and disciplined approach, we help clients turn transactions into transformation — delivering not just deals, but enduring competitive advantage.

We combine decades of consulting expertise with modern tools, data-driven insights, and innovative methodologies to deliver measurable results.

Define Your M&A Strategy

Develop a clear acquisition roadmap aligned with your long-term growth objectives, ensuring every deal supports your organization’s strategic direction.

Strengthen Deal Execution Capabilities

Build a disciplined and repeatable M&A process by empowering teams with the right tools, governance, and expertise to manage complex transactions effectively.

Elevate Due Diligence and Valuation

Adopt a fact-based, data-driven approach to uncover synergies, evaluate risks, and identify the true value potential of every target business.

Drive Seamless Post-Merger Integration

Ensure smooth operational, cultural, and financial integration that maximizes synergy realization and delivers measurable post-deal performance.

Optimize Divestitures and Carve-Outs

Plan and execute divestitures strategically to unlock trapped value, reduce complexity, and strengthen the core business for future growth.

Sustain Long-Term Value Creation

Institutionalize best practices, monitor synergy achievement, and continuously refine your M&A playbook to ensure consistent returns across future deals.

A Utility Fuels Growth Through Innovation and Data Intelligence

A leading European energy provider sought to drive innovation, accelerate growth, and enhance customer value by harnessing the power of data and digital transformation. We partnered with the company to design a data-driven innovation framework that combined advanced analytics, AI, and business design to identify new revenue streams and strengthen customer engagement.

Our approach integrated insights from 25+ data sources, generating 500+ innovation metrics to create a comprehensive, 360° business view. This enabled the client to uncover new market opportunities, refine customer journeys, and prioritize initiatives that delivered rapid, measurable impact.

We also introduced an agile “test and learn” model, empowering teams to experiment, validate ideas quickly, and scale high-potential initiatives for sustainable business growth.

Results:

Prioritized 30+ innovation-led initiatives across the business

Achieved a 4× higher success rate in market pilots versus traditional programs

Increased customer engagement and growth by 10% through new digital offerings

Flying Higher Through a Strategic M&A Framework

A major regional aviation company in Oceania sought to accelerate growth and profitability by developing a comprehensive mergers and acquisitions (M&A) strategy. The goal was to strengthen market position, expand route networks, and unlock operational synergies through targeted acquisitions and partnerships.

We partnered with the organization to design a strategic M&A roadmap focused on value creation and scalability. Our team conducted in-depth market screening, competitive benchmarking, and financial modeling to identify the most viable acquisition opportunities. We then developed a structured integration plan to align operations, streamline assets, and optimize financial performance across newly acquired entities.

Additionally, we worked with leadership to redefine the company’s post-merger value realization model, ensuring cultural alignment, governance structure efficiency, and long-term sustainability.

Results:

Identified six high-potential acquisition targets based on strategic and financial fit

Generated 500+ synergy opportunities and value creation initiatives across business units

Developed 5–10 high-impact integration priorities to accelerate post-merger performance and shareholder returns

Flying Higher with a Strategic M&A Approach

A leading domestic airline in Oceania aimed to accelerate growth and profitability through a strategic mergers and acquisitions (M&A) program that would expand market presence, strengthen operational capabilities, and create sustainable shareholder value.

We partnered with the client to redefine its acquisition strategy, combining rigorous financial analysis with market intelligence and competitive benchmarking. Our team identified high-potential targets aligned with the airline’s core strengths and developed a detailed roadmap covering due diligence, valuation modeling, and integration planning.

By assessing over ten strategic business areas, we designed a value creation framework that balanced revenue synergies, operational efficiency, and cultural integration. This structured approach enabled the airline to move beyond transactional M&A toward a long-term growth platform built on strategic alignment and execution discipline.

Results:

Identified six high-value acquisition opportunities based on market potential and strategic fit

Generated 500+ synergy and performance improvement initiatives across core and target operations

Defined 5–10 critical integration priorities to enhance post-merger success and long-term value creation

Let’s make things happen

Contact us today to learn more about how our Consulting services can help your business grow and succeed online.